Most small businesses don’t have a finance analyst on payroll. We certainly don’t. And even when we intend to review numbers weekly, urgent client work always takes priority. The result? Missed cash opportunities, late decisions, and financial blind spots that slow growth.

We know plenty of founders are in the same position. So instead of hiring an analyst, we built one.

In its first week on the job, it helped us collect $24K in outstanding AR and gave us back ~3 hours a week. Let’s walk through how we did it — and how you can too.

Like most SMBs, we knew what needed to be done: review pipeline, accounts receivable, and expenses every week. But when you’re prioritizing growth, client work, and operations, those reviews often fell down the to-do list.

This is the reality of limited bandwidth for a lot of teams. But inconsistency comes with costs: cash tied up in uncollected receivables, expense anomalies that went unnoticed, and decisions made without a clear picture of the numbers.

That gap between intention and execution is exactly why we built a workflow to act on our behalf—ensuring those critical insights aren’t getting lost in the shuffle.

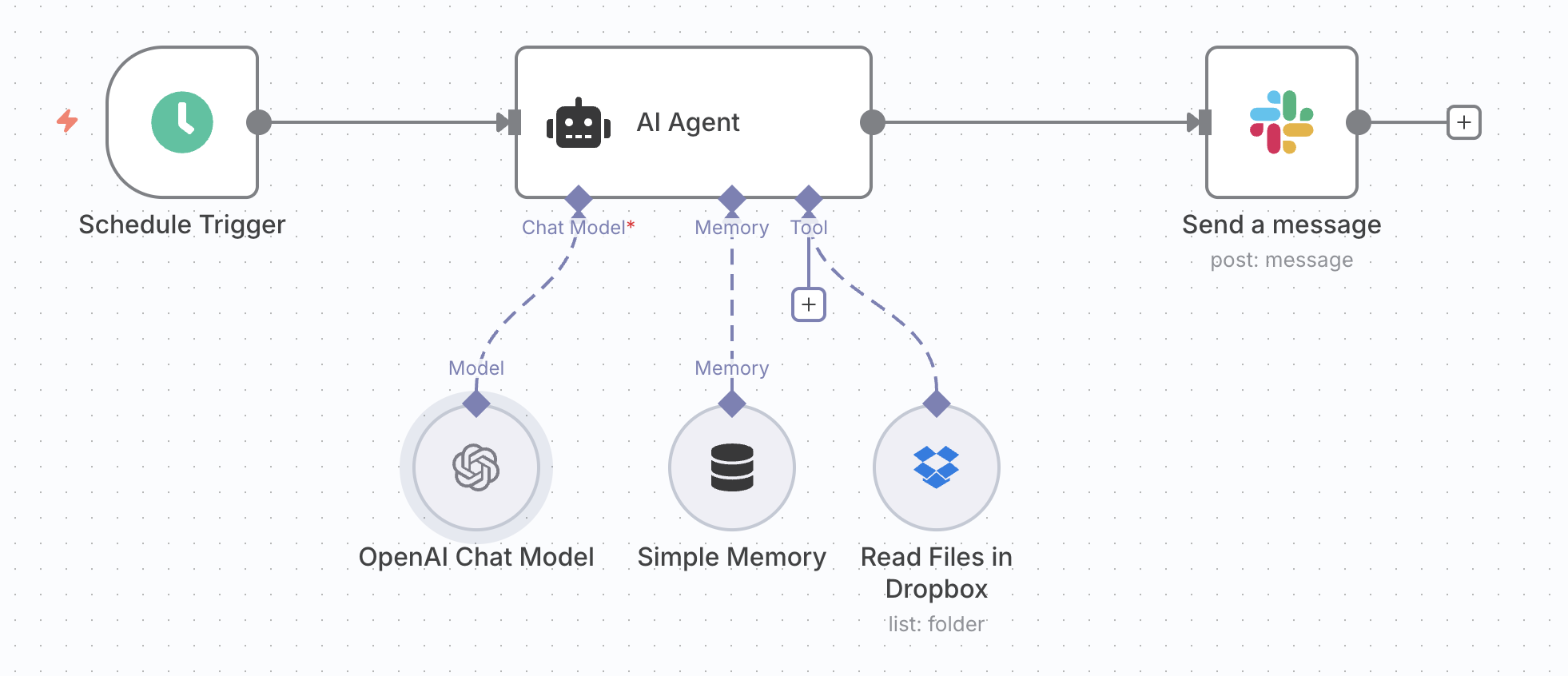

We kept the first version intentionally simple. The goal was consistency and clarity, not sophistication. Here’s what the architecture looks like:

The actual components of the workflow are fairly straightforward—here’s a quick breakdown of what each part does:

If you’ve never built a workflow before, it can feel intimidating—and that’s normal. Tools like n8n.io (which has a free version) or Zapier (a less flexible, but more user-friendly option) provide drag-and-drop builders that make automation approachable, even for non-technical users.

We used n8n to build this workflow, and while it’s intuitive, there were definitely moments where we had to troubleshoot and do a little digging. If you’re completely new to workflow tools, expect a learning curve and occasional roadblocks. It’s not always seamless—but it’s far more manageable than coding something yourself, and there are lots of online resources to guide you through.

The workflow itself is only one piece of the puzzle. The real impact comes from how you instruct the AI. The quality of your prompt determines whether the output is generic or truly actionable, helping you make smarter decisions and run your business more efficiently.

We asked GPT-4o to embody a financial analyst with a clear role description: analyze uploaded financial documents and provide specific, prioritized action items to help improve business efficiency and growth.

To guide it, we supplied a structured, repeatable framework. The AI follows these steps: assess overall financial health, analyze revenue patterns and short-term forecasts, flag expense inefficiencies, and project cash flow to anticipate timing risks.

And here’s the output format we requested: Provide an executive summary (2–3 sentences), the top 5 action items (with priority, rationale, timing, etc.), a financial forecast for the next 3 months, and alert any red flags (cash crunches, anomalies, risks)

This setup ensures that GPT-4o delivers insights in a consistent, actionable format every week.

Want to put it to use? Grab the exact prompt we use to drive consistent, actionable insights each week.

Get the PromptIf you want to use this framework to tackle other gaps in your organization, start with the simplest version. Don’t overthink the first draft.

As you adapt this workflow to other parts of your business, remember: working with financial data (or any sensitive data for that matter) requires extra care.

It’s important to slow down and get the basics right:

This workflow isn’t a magical solution. AI can misinterpret data, hallucinate, or produce misleading insights if your inputs aren’t clean. That’s why human oversight remains essential. Every recommendation should be validated by a team member before action is taken.

Think of AI as a junior analyst: it saves time by doing the grunt work, but a manager still reviews before decisions get made. We maintain consistent naming conventions, version control, and keep a detailed audit trail to ensure accountability. Ultimately, AI only amplifies a good process, it doesn’t replace the need for one.

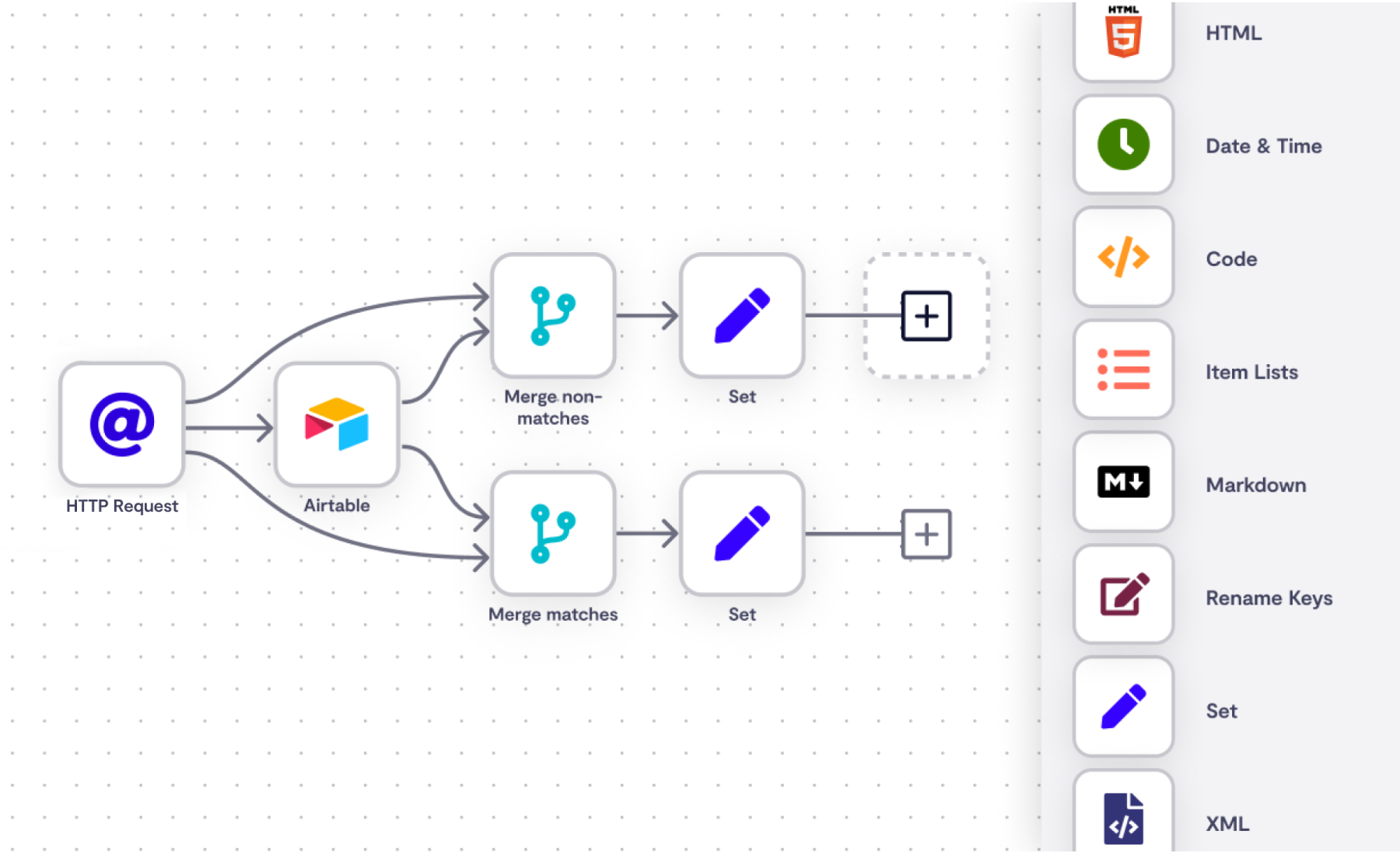

This project gave us confidence, and now we’re expanding its capabilities. Here’s what we’re working on now:

And if there’s enough demand, we may even package this workflow as a product for other SMBs. If you think a solution like this could help your business, drop us a line—we’d love to hear from you.

Ultimately, the lesson is simple: AI doesn’t have to be complex to create real value. By starting small, keeping humans in the loop, and solving a tangible problem, we turned a weekly chore into a workflow that saves time, smooths cash flow, and builds confidence in our numbers. Small, thoughtfully executed AI projects can pay for themselves fast.

Stay tuned! Once we’ve added a few new features and refined the workflow further, we’ll share a second installment with an even deeper look at how this approach can transform your everyday operations.